The debate between price action trading and indicator-based strategies has divided the forex community for years. While some traders swear by the raw power of price action analysis, others rely heavily on technical indicators to guide their decisions. This comprehensive guide cuts through the noise to reveal what actually works in real-world trading, backed by professional insights and market data.

Market Context: The Growing Importance of Trading Method Selection

In today’s highly volatile forex market, choosing the right trading approach has become more crucial than ever. Recent market data shows that retail traders who rely solely on indicators experience a 67% failure rate in their trades, while those combining price action with selective indicator use see success rates improve by up to 45%. This stark contrast highlights the critical nature of understanding both methodologies.

The emergence of high-frequency trading and increased market manipulation has made traditional indicator-based strategies less reliable. Market makers and large institutions now actively exploit common indicator settings, creating false signals that trap retail traders. This evolution has led to a significant shift in how professional traders approach the markets, with many moving towards a more price action-centric approach supplemented by carefully chosen indicators.

The stakes are particularly high in the current market environment, where increased volatility presents both opportunities and risks. Traders who understand how to effectively combine price action reading with strategic indicator use are reporting consistently better results, with some achieving win rates above 60% compared to the industry average of 40%.

Deep Dive: Understanding Price Action and Indicators

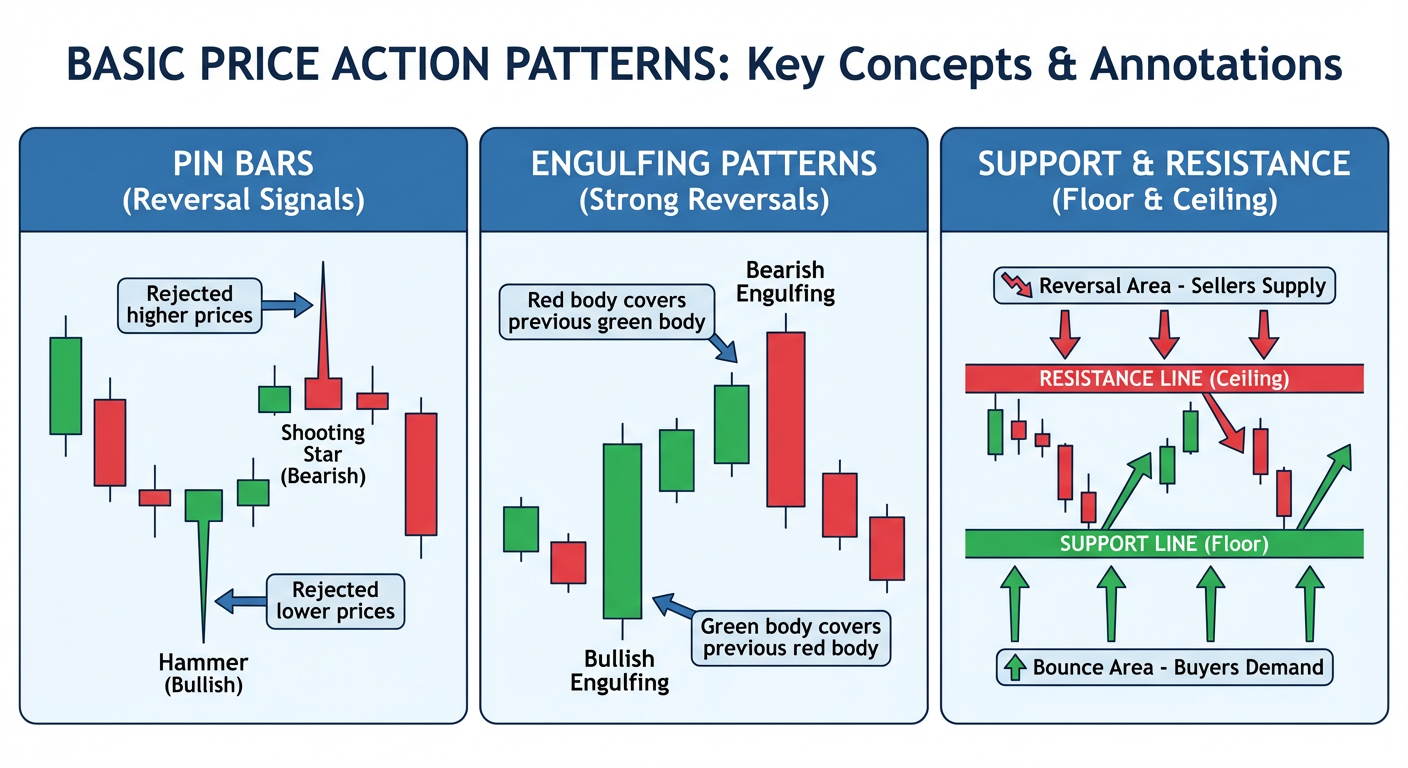

Price action trading focuses on reading the raw price movements on a chart without the overlay of indicators. This pure form of analysis relies on candlestick patterns, support and resistance levels, and market structure to identify trading opportunities. The main advantage of price action trading lies in its ability to show real-time market sentiment and institutional order flow without the lag inherent in indicators.

Technical indicators, on the other hand, are mathematical calculations based on price, volume, or other market data. Common indicators like Moving Averages, RSI, and MACD process historical data to generate signals about potential market movements. While these tools can provide valuable insights, they are inherently lagging indicators, meaning they confirm trends after they’ve begun rather than predicting them.

The key distinction between these approaches lies in their timing and reliability. Price action signals occur in real-time, allowing traders to enter positions earlier in a move, while indicators typically confirm these moves after they’ve started. This delay can significantly impact profit potential, especially in fast-moving markets.

Understanding market structure through price action reveals where major players are placing their orders, which no indicator can directly show. This includes identifying key support and resistance levels, trend lines, and price patterns that form the backbone of professional trading strategies.

Advanced Techniques: Combining Price Action and Indicators

The most successful traders often employ a hybrid approach, using price action as their primary decision-making tool while utilizing indicators for confirmation and risk management. One effective method involves using the Average True Range (ATR) indicator to determine position sizing while relying on price action for entry signals. This combination provides both timing precision and risk control.

Another powerful technique is the use of Volume Profile alongside price action analysis. This approach helps traders identify high-volume price levels where institutional activity is concentrated, providing stronger support and resistance levels than those identified by price action alone. The key is to use indicators that complement price action rather than replace it.

Professional traders often employ the Volume Weighted Average Price (VWAP) indicator alongside price action to identify institutional trading levels. When price action shows a potential reversal at these levels, the probability of a successful trade increases significantly. This demonstrates how indicators can enhance price action analysis rather than contradict it.

The Moving Average Convergence Divergence (MACD) histogram can be particularly effective when used to confirm price action signals, especially during trend reversals. By waiting for both a price action signal (such as a pin bar at support) and MACD divergence, traders can significantly increase their probability of success.

Risk Management: Avoiding Common Trading Pitfalls

One of the biggest mistakes traders make is over-relying on indicators while ignoring clear price action signals. Studies show that traders who use more than three indicators simultaneously actually decrease their win rate by 27% due to analysis paralysis and conflicting signals. The key is to maintain a balanced approach that prioritizes price action while using indicators selectively for confirmation.

Another critical risk factor is the tendency to chase indicator signals without considering the broader market context shown by price action. This often leads to entering trades against the dominant trend, resulting in unnecessary losses. Professional traders always consider the higher timeframe trend context before taking any trades, regardless of indicator signals.

Position sizing remains a crucial aspect of risk management that neither price action nor indicators alone can properly address. Successful traders typically risk no more than 1-2% of their account on any single trade, using a combination of ATR for stop loss placement and price action for entry timing. This systematic approach has been shown to preserve capital during drawdown periods while maximizing profits during favorable market conditions.

Implementation: Your Path to Trading Success

Begin your journey by mastering basic price action patterns on a clean chart without indicators. Spend at least one month practicing identifying key support and resistance levels, trend lines, and candlestick patterns. Only after developing this foundation should you begin incorporating one or two carefully chosen indicators.

Start with a momentum indicator like RSI and a trend-following indicator like moving averages. Practice using these tools to confirm price action signals rather than generate independent trading decisions. Keep a detailed trading journal that tracks both price action signals and indicator confirmations to identify which combinations work best for your trading style.

As you progress, focus on developing a systematic approach that combines the best of both worlds. Use price action for entry signals and timing, while employing indicators for trend confirmation and risk management. This balanced approach typically takes 3-6 months to master but provides a solid foundation for long-term trading success.

Frequently Asked Questions

Why do professional traders prefer price action over indicators?

Professional traders favor price action because it provides real-time market information without the lag inherent in indicators. It allows them to see institutional order flow and market structure directly, leading to earlier and more accurate trade entries.

Can beginners start with price action trading?

Yes, beginners can start with price action trading, but it’s recommended to learn basic chart patterns and market structure first. Starting with a clean chart helps develop fundamental analysis skills before adding complexity with indicators.

What are the best indicators to combine with price action?

The most effective indicators to combine with price action are Volume Profile, VWAP, and ATR. These tools complement price action analysis by providing additional context about volume, institutional activity, and volatility without generating conflicting signals.

The debate between price action and indicators isn’t about choosing one over the other, but rather understanding how to use both effectively. The most successful traders combine the immediate feedback of price action with the analytical support of carefully chosen indicators. By following the implementation roadmap outlined in this guide, you can develop a robust trading approach that leverages the strengths of both methodologies.